Is a ‘Nuclear Renaissance’ Possible in the United States?

In May, President Donald Trump signed four executive orders to facilitate the construction of nuclear reactors and the development of nuclear energy technology; the orders aim to cut red tape, ease approval processes, and reshape the role of the main regulatory agency, the Nuclear Regulatory Commission, or NRC. These moves, the administration said, were part of an effort to achieve American independence from foreign power providers by way of a “nuclear energy renaissance.”

Self-reliance isn’t the only factor motivating nuclear power proponents outside of the administration: Following a decades-long trend away from nuclear energy, in part due to safety concerns and high costs, the technology has emerged as a potential option to try to mitigate climate change. Through nuclear fission, in which atoms are split to release energy, reactors don’t emit any greenhouse gases.

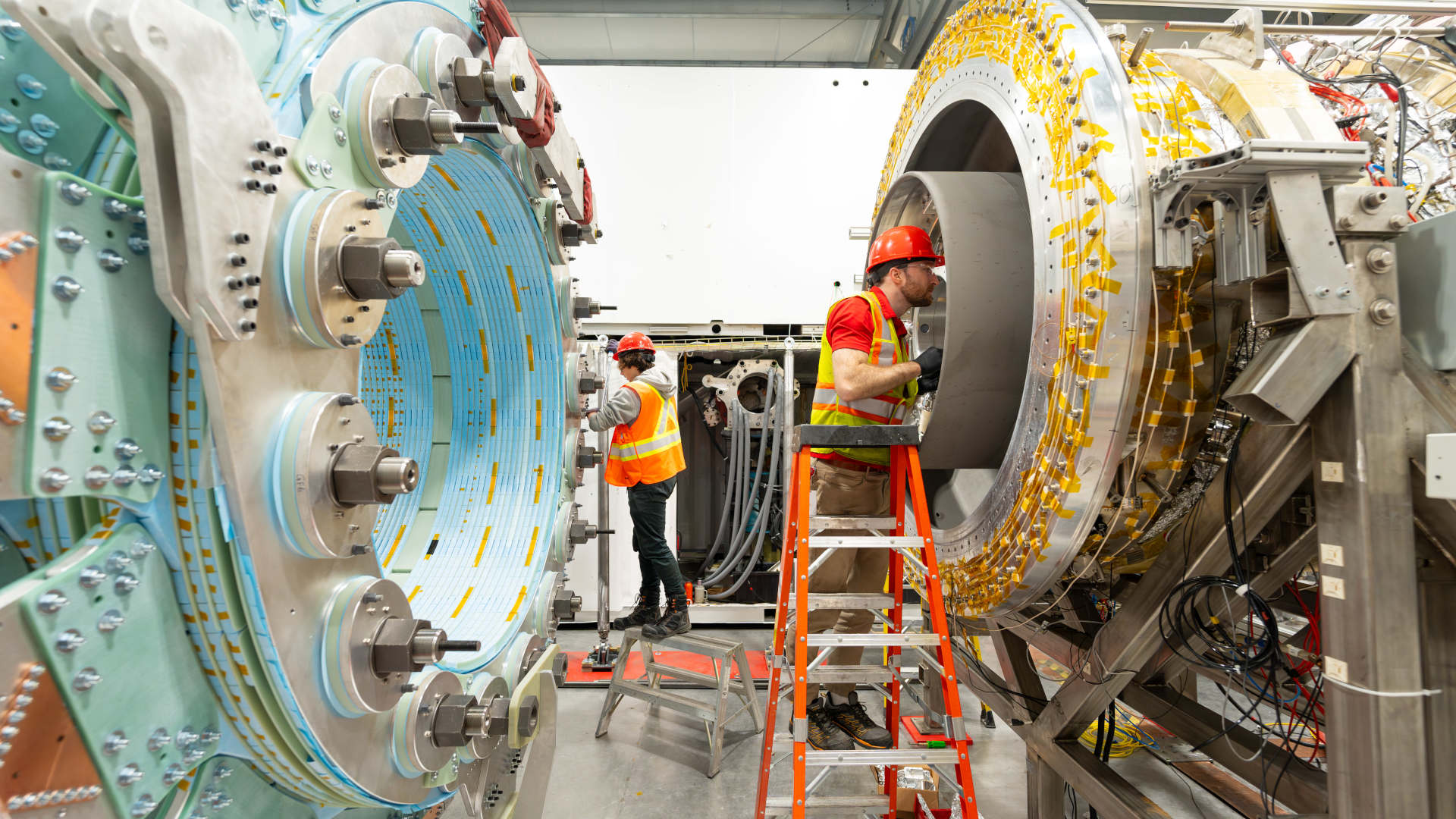

The Trump administration wants to quadruple the nuclear sector’s domestic energy production, with the goal of producing 400 gigawatts by 2050. To help achieve that goal, scientific institutions like the Idaho National Laboratory, a leading research institute in nuclear energy, are pushing forward innovations such as more efficient types of fuel. Companies are also investing millions of dollars to develop their own nuclear reactor designs, a move from industry that was previously unheard of in the nuclear sector. For example, Westinghouse, a Pennsylvania-based nuclear power company, plans to build 10 new large reactors to help achieve the 2050 goal.

However, the road to renaissance is filled with familiar obstacles. Nuclear energy infrastructure is “too expensive to build, and it takes too long to build,” said Allison Macfarlane, a science and technology policy expert at the University of British Columbia who used to chair the NRC from 2012 to 2014.

And experts are divided on whether new nuclear technologies, such as small versions of reactors, are ready for primetime. The nuclear energy field is now “in a hype bubble that is driving unrealistic expectations,” said Edwin Lyman, the director of nuclear power safety at the Union of Concerned Scientists, a nonprofit science advocacy organization that has long acted as a nuclear safety watchdog.

The nuclear energy field is now “in a hype bubble that is driving unrealistic expectations.”

Meanwhile, the Trump administration is trying to advance nuclear energy by weakening the NRC, Lyman said. “The message is that it’s regulation that has been the obstacle to deploying nuclear power, and if we just get rid of all this red tape, then the industry is going to thrive,” he added. “I think that’s really misplaced.”

Although streamlining the approval process might accelerate development, the true problem lies in the high costs of nuclear, which would need to be significantly cheaper to compete with other sources of energy such as natural gas, said Koroush Shirvan, a nuclear science researcher at the Massachusetts Institute of Technology. “Even the license-ready reactors are still not economical,” he said. If the newer reactor technologies do pan out, without government support and subsidies, Shirvan said, it is difficult to imagine them “coming online before 2035.”

Rumblings of a nuclear renaissance give experts a sense of déjà vu. The first resurgence in interest was around 2005, when many thought that nuclear energy could mitigate climate change and be an energy alternative to dwindling supply and rising prices of fossil fuels. But that enthusiasm slowed mainly after the Fukushima accident in 2011, in which a tsunami-triggered power outage — along with multiple safety failures — led to a nuclear meltdown at a facility in Japan. “So, the first nuclear renaissance fizzled out,” said Lyman.

Globally, the proportion of electricity provided by nuclear energy has been dwindling. Although there has been an increase in generation, nuclear energy has contributed less to the share of global electricity demand, dropping to 9 percent in 2024 from a peak of about 17 percent in 2001. In the U.S., 94 reactors generate about a fifth of the nation’s electricity, a proportion that has held steady since 1990s. But only two of those reactors have come online in the last nearly 30 years.

This renewed push is “a second bite at the apple, and we’ll have to see but it does seem to have a lot more of a headwind now,” said Lyman.

Globally, the proportion of electricity provided by nuclear energy has been dwindling.

Much of that movement comes from the private sector, said Todd Allen, a nuclear engineer at the University of Michigan. In the last couple of decades, dozens of nuclear energy companies have emerged, including TerraPower, co-founded by Bill Gates. “It feels more like normal capitalism than we ever had in nuclear,” Allen said. Those companies are working on developing the large reactors that have been the backbone of nuclear energy for decades, as well as newer technologies that can bolster the field.

Proponents say small modular reactors, or SMRs, and microreactors, which generate less than 300 megawatts and 20 megawatts, respectively, could offer safer, cheaper, and more flexible energy compared to their more traditional counterparts. (Large reactors have, on average, 900 megawatts of capacity.)One 2022 study found that modularization can reduce construction time by up to 60 percent.

These designs have taken the spotlight: In 2024, a report estimated that the SMR market would reach $295 billion by 2043. In June, Energy Secretary Chris Wright told Congress that DOE will have at least three SMRs running by July of next year. And in July of this year, the Nuclear Energy Agency launched a dashboard to track SMR technologies around the world, which identified 74 SMR designs at different stages around the world. The first commercial SMR in North America is currently being constructed in Canada, with plans to be operational by 2030.

But whether SMRs and microreactors are actually safer and more cost-effective remains to be determined. A 2022 study found that SMRs would likely produce more leakage and nuclear waste than conventional reactors. Studying them, though, is difficult since so few are currently operational.

In part, that may be because of cost. Multiple analyses have concluded that, because of rising construction and operating costs, SMRs might not be financially viable enough to compete for the world’s energy markets, including in developing countries that lack affordable access to electricity.

And recent ventures have hit road bumps: For example, NuScale, the only SMR developer with a design approved by the NRC, had to shut down their operations in November 2023 due to increasingly high costs (though another uprated SMR design was approved earlier this year).

“Nothing is really commercialized yet,” said Macfarlane. Most of the tech companies haven’t figured out expenses, supply chains, the kind of waste they are going to produce or security at their reactors, she added.

Fuel supply is also a barrier since most plants use uranium enriched at low rates, but SMRs and microreactors use uranium enriched at higher levels, which is typically sourced from Russia and not commercially available in the U.S. So scientists at the Idaho National Laboratory are working to recover enriched uranium from existing reactors and developed new, more cost-effective fuels, said Jess Gehin, the associate laboratory director for the Nuclear Science & Technology Directorate at the INL. They are also using artificial intelligence and modeling simulation tools and capabilities to optimize nuclear energy systems, he added: “We got to reach 400 gigawatts, we need to accelerate all of this.”

Most of the tech companies haven’t figured out expenses, supply chains, the kind of waste they are going to produce or security at their reactors.

Companies are determined to face and surpass these barriers. Some have begun pouring concrete, such as one nuclear company called Kairos Power that began building a demo of their SMR design in Tennessee; the plant is projected to be fully operational by 2027. “I would make the case that we’re moving faster than many in the field, if not the fastest,” Mike Laufer, the company’s CEO and co-founder, told Reuters last year.

Some experts think achieving nuclear expansion can be done — and revel in the progress so far: “I would have never thought we’d be in this position where we’re working so hard to expand nuclear, because for most of my career, it wasn’t that way,” said Gehin. “And I would say each month that goes by exceeds my expectations on the next bigger things that are coming.”

Although the Trump administration aims to accelerate nuclear energy through executive orders, in practice, it has not allocated new funding yet, said Matt Bowen, an expert on nuclear energy, waste, and nonproliferation at Columbia University’s Center on Global Energy Policy. In fact, the initial White House budget proposed cutting $4.7 billion from the Department of Energy including $408 million from the Office of Nuclear Energy allocated for nuclear research in the 2026 fiscal year.

“The administration was proposing cuts to Office of Nuclear Energy and DOE more broadly, and DOGE is pushing staff out,” said Bowen. “How you do more with less? Less staff, less money.”

The Trump administration places the blame for the nuclear sector’s stagnation on the NRC, which oversees licensing and recertification processes that cost the industry millions of dollars each year in compliance. In his executive orders, Trump called for a major reorganization of the NRC. Some of the proposed changes, like streamlining the approval process (which can take years for new plants), may be welcomed because “for a long time, they were very, very, very slow,” said Charles Forsberg, a nuclear chemical engineer at MIT. But there are worries that the executive orders could do more than cut red tape.

“This notion that the problem for nuclear energy is regulation, and so all we need to do is deregulate, is both wrong and also really problematic.”

“Every word in those orders is of concern, because the thrust of those orders is to essentially strip the Nuclear Regulatory Commission of its independence from the executive branch, essentially nullifying the original purpose,” said Lyman.

Some experts fear that with these new constraints, NRC staff will have less time and fewer resources to do their jobs, which could impact power plant safety in the future, Bowen said: “This notion that the problem for nuclear energy is regulation, and so all we need to do is deregulate, is both wrong and also really problematic.”

The next few decades will tell whether nuclear, especially SMRs, can overcome economic and technical challenges to safely contribute to decarbonization efforts. Some, like Gehin, are optimistic. “I think we’re going to accelerate,” he said. “We certainly can achieve a dramatic deployment if we put our mindset to it.”

But making nuclear financially competitive will take serious commitment from the government and the dozens of companies, with many still skeptical, Shirvan said. “I am quite, I would say, on the pessimistic scale when it comes to the future of nuclear energy in the U.S.”