Should Your Kidney Doctor Have a Financial Stake in Dialysis?

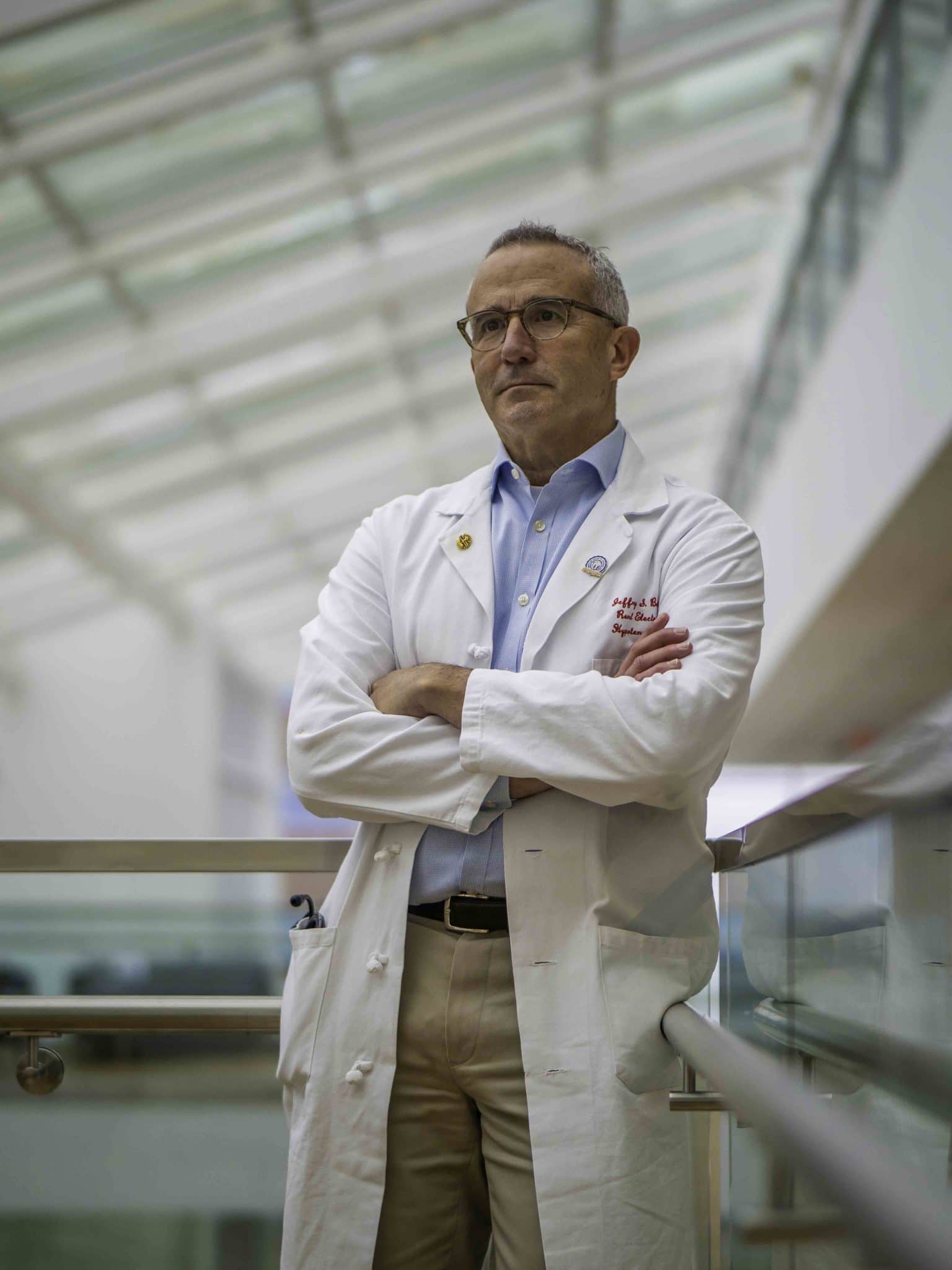

When Jeffrey Berns first began practice as a nephrologist in the late 1980s, kidney disease in the U.S. was in the early stages of a stratospheric rise. In 1972, Congress had passed legislation that made anyone with end-stage renal disease, or ESRD — the current formal medical diagnosis for kidney failure — eligible for Medicare. Unlike private insurance, which rarely covered dialysis at the time, Medicare did, and the nation was at the dawn of a dialysis demand boom. The only question for the marketplace was: Who was going to step in to meet that demand?

The answer wasn’t immediately obvious. People with ESRD present some of the most complex cases in all of medicine, says Berns. They often have a variety of co-occurring conditions, from anemia to diabetes to heart failure, and this makes managing their care time-consuming — something that many doctors say isn’t adequately reimbursed in the Medicare fee for a basic appointment.

PROFIT & LOSS: THE COMPLETE SERIES

Intro | The Market | The Conflicts | The Disparities | The Waiting | The Alternatives

Independent and hospital-based dialysis clinics began popping up in the 1960s and 70s, but thanks to an aging population and rising rates of diabetes and high blood pressure, the ESRD population grew so quickly that the dialysis industry couldn’t keep up. Although the dialysis industry was incredibly lucrative, startup costs were, and still are, steep, according to Deepak Jasuja, a nephrologist with Columbus Regional Health outside Indianapolis.

What emerged was the joint venture, an entrepreneurial arrangement that lets two or more individuals share in the risks and benefits of a business. In the case of kidney disease treatment, two key services were in play: the diagnosis and management of care for the patient, including prescribing dialysis, by a nephrologist and the delivery of mechanical dialysis itself, where the filtering that would normally be done by the kidney is done by machine.

It proved a winning solution, and in the decades since Berns entered the field, the number of dialysis clinics has exploded. By 2008, the average zip code in the U.S. had 1.2 dialysis clinics, with some having as many as seven. The problem, says Berns, is that no one outside the two big chains that own most dialysis clinics has any idea of how many are operated as joint ventures, and how that arrangement can influence medical decision making.

Berns — who before decamping in 1999 to the University of Pennsylvania and a career in academic medicine was briefly part of a practice in Virginia where other doctors had a joint venture arrangement — says that patients often don’t know that their doctors might have a financial stake in the dialysis clinics to which they are referred. Among other important issues, Berns suggests, the arrangement leaves many nephrologists with a financial incentive to steer patients to their co-owned clinics for dialysis, even when other, perhaps even better or more appropriate interventions like medication and lifestyle changes are available. And worst of all, Berns argues, most of his colleagues in the wider medical community seem largely unconcerned about the potential conflicts of interest.

“If you really look at the corporation’s obligation to shareholders and you take that seriously, and you take the obligation to patients seriously, I think they’re fundamentally incompatible,” said Klemens Meyer, a nephrologist and director of dialysis services at Tufts Medical Center. “And I think that this is whitewashed over.”

Not everyone shares this sense of alarm. The rise of joint ventures has helped greatly expand the number of dialysis clinics in the country, which has given patients more options and the ability to be treated closer to home. This is a huge benefit to people who typically have to travel to treatment three times a week, rain or shine, says nephrologist Alvin Moss at West Virginia University. (While Medicare announced a new program this fall that seeks to increase the number of patients using at-home dialysis, for now, the majority continue to receive treatment in a clinic.)

Of joint ventures, Moss doesn’t deny that the potential for conflicts of interest is real, but he says that with guidelines and institutional oversight these physicians can still put their patient’s interests ahead of their own.

But Berns is convinced that the problem is significant enough that he — alongside a small cadre of likeminded experts — has made it a mission to expose and address what he considers to be the inherent and too-often ignored conflicts that underpin the delivery of dialysis treatment in the United States. Along the way — and using the federal Freedom of Information Act to obtain records on the more than 7,500 dialysis clinics in the U.S. — he has earned a reputation as a gadfly and the ire of many of his professional colleagues. That’s fine, Berns says, if a little light can be shed on an otherwise opaque marketplace.

“People can study whether or not for-profit dialysis has different outcomes than not-for-profit dialysis because it’s public knowledge,” he said. “But you can’t do a study of joint venture because no one knows which ones are and aren’t.”

No sooner had the Seattle Artificial Kidney Center opened its doors on January 1, 1962 than its anonymous seven-member admissions and policy committee faced an awesome decision. Their task was to decide which of the Pacific Northwest’s thousands of kidney failure patients would receive treatment on one of the center’s three new dialysis machines. The contraptions were inefficient and it took an overnight stay for a single machine to filter toxins from the blood of a patient. And despite being cobbled together from spare parts from nearby hospitals and a local soft serve ice cream machine manufacturer, they were still quite costly.

Of the first 30 patients referred to the committee, only 17 met the stringent pre-screening medical criteria. The committee selected 10 of these patients for dialysis; the other patients died from kidney failure.

Even as late as the early 1980s, as kidney disease rates were mounting their historic climb, dialysis services could be hard to come by. Moss, then a nephrologist in Morgantown, West Virginia, recalls many of his patients driving upwards of two hours each way to the closest clinic. For the standard thrice-weekly regimen of treatments, travel was a huge burden on patients, Moss says — and that’s partly what helped drive the joint venture model. “Before they were everywhere,” Moss said, “nephrologists were getting involved in joint ventures to try and get dialysis centers more widely available.”

The arrangement is, in many respects, a natural and obvious one. The intimate relationship between nephrology and dialysis, combined with the challenges of coordinating the complex medical needs of ESRD patients, means that nephrologists have a built-in incentive to open their own dialysis clinic, even independent of the fact that it can be highly profitable.

But while nephrologists have the medical expertise needed to care for patients in kidney failure, they can benefit from having business partners who know more about balancing the books and managing complex income streams. A joint venture allows each contributor to play to their own strengths, explains Nick Hernandez, a consultant who specializes in advising physicians.

Joint ventures have become a mainstay in medicine for a variety of other reasons, says Hernandez. Perhaps most importantly, a joint venture allows participants, who may include multiple physicians who might otherwise be competing against one another, to pool their resources to get a new dialysis clinic up and running, sharing in both the risks and the rewards. It can take $3 million or more in startup costs to get a new clinic off the ground, an amount that would be shared among the joint venture participants, and if more cash is needed at any point, the participants share proportional responsibility in raising that capital.

And the ownership structure of joint ventures is flexible. Investing more money at the outset means that person is taking on a greater risk, Hernandez says, but it also means they will take in a larger share of the rewards, whether it’s the clinic’s profits or payouts if the small startup clinic is bought out by a larger dialysis chain. Physicians see additional rewards from joint venture dialysis clinics, since these facilities also provide a steady source of patient referrals for nephrologists, according to Jasuja. In all, he said, “it’s a big chunk of financial revenue that can potentially come from these sources.”

A July 2019 report from the research firm Marketdata estimates that the more than 7,500 dialysis clinics in the country today pull in more than $3 million in receipts annually on average, with an estimated net profit margin of 18 percent. In a health care market where profit margins like this are increasingly rare, dialysis clinics can be attractive investment options for young nephrologists, explains Hernandez.

In the 1980s, when dialysis clinics were relatively rare and the need for such centers far outstripped their supply, Moss said that the possibility of sharing in the profits from treatment provided much-needed incentives for nephrologists to build more dialysis centers. “There were so few downsides,” he said.

The number of outpatient dialysis centers nearly doubled between 2001 and 2011, but with the boom came a wave of consolidation, and today some 70 percent of all dialysis clinics in the U.S. are owned by just two firms: Denver-based DaVita, and Fresenius, which is headquartered in Bad Homburg, Germany.

Joint ventures have evolved with this vastly different dialysis landscape. According to Hernandez, this arrangement helps mitigate some of the risk of opening an independent clinic, and with parts of the country still underserved by dialysis centers, Moss says the model continues to provide incentives for entrepreneurially-minded nephrologists to meet this need. DaVita’s webpage on joint ventures and acquisitions showed that the number of joint venture clinics partly owned by the company has risen from 259 in 2008 to 671 in 2018, equaling one-quarter of the chain’s 2,625 outpatient dialysis centers in the U.S. at the time.

The problem is that for many early career nephrologists, joint venture dialysis clinics are the only way they can stay afloat, says Nelson Kopyt, a nephrologist at Lehigh Valley Hospital in Allentown, Pennsylvania. Competition from hospitals and large nephrology group practices can make it all but impossible for young nephrologists to run a small, independent practice. With six-figure medical school debt and facing a specialty choice with long hours and relatively low pay, owning a piece of a dialysis clinic is a lifeline, he says.

And it’s these benefits that DaVita emphasizes in its own promotional literature on the subject. Of the six reasons it provides nephrologists to consider a joint venture, only one has to do with improving patient care. The other five concern financial benefits for the investing physician.

As a joint venture participant during his early career, Berns knows all of this well. Especially for young nephrologists, joint venture dialysis clinics can seem like the only viable path. Large dialysis providers like DaVita and Fresenius are equally attached to this model, he says. “Dialysis facilities prefer that because the nephrologist has some skin in the game,” Berns said. “And it’s a way for nephrologists to have a revenue stream that’s not directly related to seeing a patient.”

Because physicians have their own money on the line, they may have an additional incentive to see that the clinic provides good care so that it is profitable, acknowledged Berns. It’s something that patients may also see as a plus, if they trust their doctor and their recommendations. But Moss said that physicians don’t generally need a financial motivator to provide quality care, and acknowledged that these same financial incentives could also cause a physician to subconsciously steer patients towards their own clinic and away from options that might be more beneficial.

It’s a classic case of conflict of interest, says Matthew McCoy, a colleague of Berns’ at Penn. “If you own a share in the facility,” he said, “there’s financial incentives to get patients there and keep them there.”

Berns began thinking about these potential conflicts several years ago when the University of Pennsylvania sought his advice about their hospital’s financial participation in an ESRD Seamless Care Organization (ESCO). Pioneered by the Centers for Medicare and Medicaid Services, an ESCO is a partnership between dialysis clinics, physicians, and hospitals to innovate and improve the care of patients in kidney failure. In his conversations with hospital executives, Berns outlined some of his ethical concerns about the hospital system entering a joint venture ESCO. Even if the hospital didn’t deliberately steer patients towards receiving care at Penn’s own ESCO, employees could feel subconscious pressure to do that.

As he increasingly thought about conflicts of interest and joint ventures, Berns realized that physicians who co-owned dialysis clinics as part of a joint venture could also feel that pressure. Even more problematic was the fact that doctors aren’t required to tell their patients about joint venture participation.

“As employees of the dialysis facility, we’re having conversations with patients about whether or not they should continue dialysis,” he said. “It made me sort of unsettled to think that an employee of a dialysis company that stands to benefit if that patient starts dialysis is having that discussion with the patient and not divulging that fact.”

That physicians should prioritize the interests of their patients above all else, including their own financial benefit, forms one of the central tenets of medicine. But in reaction to reports of widespread Medicare and Medicaid abuse and fraud, in 1989 Congress enacted what came to be known as the Stark Law to prevent doctors from referring patients to other clinics in which they have a financial relationship.

Joint venture dialysis facilities take advantage of certain exceptions written into Stark Law rules, but a closely related federal law, the Anti-Kickback Statute, prohibits payments for patient referrals. So when David Barbetta, an accountant with DaVita, noticed that the company was selling physicians shares in existing dialysis clinics at below-market rates and buying shares in new joint ventures at artificially inflated rates, he believed something shady was happening. What Barbetta uncovered was DaVita giving kickbacks to nephrologists but disguising the payouts as profits from joint ventures.

So Barbetta filed a whistleblower lawsuit in 2009, the proceedings of which were eventually unsealed in 2015. The lawsuit alleges that when Barbetta approached DaVita executives about his concerns, they brushed him off. He recalled one telling him not to “give me any of that ethics nonsense.” For Eric Havian and Jessica Moore, Barbetta’s attorneys, the case was relatively straightforward.

“We immediately looked at it and said, you know, this is just a plain old kickback scheme,” said Havian. “This is just a way for DaVita to put a lot of extra money in doctors’ pockets in exchange for doctors referring patients to their dialysis clinics.”

After the Department of Justice joined the suit and initiated an investigation into DaVita’s practices, the company agreed in October 2014 to pay $350 million to resolve the allegations that they paid illegal kickbacks, plus an additional $39 million to settle other claims. At the time the settlement agreement was announced the company said in a press release, “it is our belief there was no intentional wrongdoing.”)

The American fee-for-service medical system is rife with potential for these types of kickbacks and conflicts, says Meyer of Tufts Medical Center. It’s why, he said, “if you have the stock market sucking away resources, you just have a mess left over to take care of the patient, even though the people on the ground at the bedside may all have the best intentions and be very, very devoted.”

Berns and McCoy also wanted to know how these joint ventures impacted patient care.

For years, the U.S. government has gathered reams of data on dialysis clinics, most of which is available through the United States Renal Data System. But the database didn’t include any information about which dialysis clinics were joint ventures, let alone the parties that owned them. So Berns filed a request under the Freedom of Information Act in 2016 with the Centers for Medicare and Medicaid Services (CMS). Surely, he felt, they would be able to tell him whether a dialysis clinic was a joint venture, given the detailed information they collected about these facilities. It took more than a year for Berns to get a response. When he finally did, Berns assumed that data on every dialysis clinic’s joint venture status would only be a click of a mouse away. But when Berns and McCoy pored over the files given to them by CMS, they found nothing about joint ventures.

“That’s what we asked for and we didn’t get,” Berns said.

Seeking data on the number of joint venture dialysis clinics, Berns filed a request under the Freedom of Information Act. The files sent back were silent on the issue. “That’s what we asked for and we didn’t get,” Berns said.

The pair realized that if CMS didn’t know which dialysis clinics were joint ventures, then patients didn’t know, either, and this raised its own ethical quandaries. Over the past decade, a variety of laws had been passed to allow patients to see whether their doctors had received money from pharmaceutical companies, but no such law existed about physicians disclosing their financial interests in dialysis clinics.

Berns, McCoy, and Penn bioethicist Aaron Glickman formally raised these concerns in a 2018 article in the New England Journal of Medicine. They acknowledged that participating in a joint venture doesn’t mean a physician is inherently unethical, but they argued that patients have a right to know if their doctor has a financial stake in their dialysis care. “This lack of transparency not only poses a major barrier for evidence-based health care policy,” the authors wrote, “but also deprives patients of critical information.”

Berns points to the New Jersey endoscopy clinic where he himself is a patient. On the wall, he said, is a sign that clearly indicates who the owners are. Dialysis clinics should have something similar, he said.

Both Meyer and Moss shared Berns and his colleagues’ concerns, as did many other physicians who responded to the NEJM article, Berns says. Others, however, were less convinced. In a blog post, nephrologist Terry Ketchersid, now an executive vice president at Fresenius, penned a detailed response, calling Berns and his colleagues naive and short-sighted. “[T]he authors are living in the dark ages, hanging on to vestiges of a transactional fee-for-service framework, and penning perspectives that might have been relevant when I was a teenager,” he wrote. “I suspect it’s easy to sit in the confines of this particular institution and cast stones at ethical, hardworking nephrologists who care for some of the sickest patients on the planet.”

Ketchersid declined to speak with Undark, but Berns regarded reactions like these to be an indicator that the issue was important and worth investigating further. In a follow-up piece published earlier this year, Berns, Glickman, and UCLA nephrologist Eugene Lin argued that the lack of openness around joint ventures in nephrology was also interfering with the federal government’s ability to change how it pays providers for dialysis treatment. With everyone profiting from the current arrangement except for patients, dialysis clinics have little incentive to change. If CMS doesn’t account for these potential conflicts of interest when it tries to implement payment reforms for dialysis, it risks making the problem even worse, the trio argued.

“It’s hard to simply eliminate these kinds of financial incentives with the snap of a finger,” McCoy said.

Berns repeatedly emphasized that he wasn’t implying that financial conflicts of interest mean that a physician is unethical and in it just for the money. Berns says that for all he knows, joint ventures could potentially improve patient care, but since the government doesn’t collect that data, he and other researchers have no way of knowing. It’s something he has found frustrating to the point of maddening.

So Berns has begun the laborious task of contacting every clinic on the list he received from his FOIA request to determine whether it is a joint venture, so he and his colleagues can determine if and how this arrangement impacts factors like transplant rate, infection, and death.

“No one can do studies on the question of physician ownership because the information is so hard to obtain,” Berns said. “Patients and their families should have a right to know who has an ownership stake.”

UPDATE: An earlier version of this piece, along with a photo caption, imprecisely described Dr. Jeffrey Berns as having previously been a partner in a dialysis joint venture. While Berns was part of a practice in Virginia where the other doctors had a joint venture arrangement, he was not himself a partner. Separately, the original version of this piece stated that DaVita had declined to comment on a whistleblower lawsuit filed against it, but included a quote from a statement the company made at the time the suit was settled in 2014. In fact, DaVita was not offered an opportunity to comment during the reporting process. In follow-up phone calls and emails with DaVita post-publication, a spokesperson said the company had no comment beyond what was offered in the statement. The piece also originally described Nick Hernandez as a certified financial planner. He is a consultant.

This series was supported in part by the National Institute for Health Care Management Foundation.

Carrie Arnold is an award-winning freelance science journalist based in Virginia. In addition to Undark, her work has appeared with Scientific American, STAT, National Geographic, Wired, and The New York Times, among other publications.

Larry C. Price is a two-time Pulitzer Prize-winning documentary photographer and multimedia journalist based in Dayton, Ohio. He previously produced award-winning photography and video footage for Undark’s Breathtaking series on air pollution, which won a George Polk Award for Environmental Reporting in 2018.

PROFIT & LOSS: THE COMPLETE SERIES

Comments are automatically closed one year after article publication. Archived comments are below.

The logic behind this report is founded on multiple false assumptions and contains several flaws.

for example, “…THAT PHYSICIANS SHOULD prioritize the interests of their patients above all else, including their own financial benefit, forms one of the central tenets of medicine. But in reaction to reports of widespread Medicare and Medicaid abuse and fraud, in 1989 Congress enacted what came to be known as the Stark Law to prevent doctors from referring patients to other clinics in which they have a financial relationship.” First, prioritize does not mean ignore their own financial well-being. Second, widespread fraud and abuse make it sound like most physicians were stealing money from CMMS. That is not supported with evidence, and I know that fraud and abuse were as hypothetical as real. I would challenge the author, and his sources, to carry the logic of their claims to a full exposition. Innuendo does not prove a point.

Article incorrectly states Nick Hernandez is a “certified financial planner.” He is a transactional consultant who works with physician clients on strategic healthcare initiatives.

Hi Nick – Thanks for bringing this to our attention, and apologies for the error. We’ll correct this. -TZ